The present weakness could be the last weak phase in INR for a long time to come !!

The Indian Rupee has been weakening against USD, but is still one of the better performer currency.

The INR has fell sharply to 66.80 from 64.10 about a month back, largely due to dollar outflow triggered by the sharp decline in the equities. The depreciation of the yuan has triggered similar moves in Asian currencies, but more so for currencies of countries which are highly trade-dependent such as Singapore and South Korea. The rupee fell less markedly against the greenback, its move more in line with that of Thailand’s baht. But the daily USD/INR chart suggests more weakness may be in store.

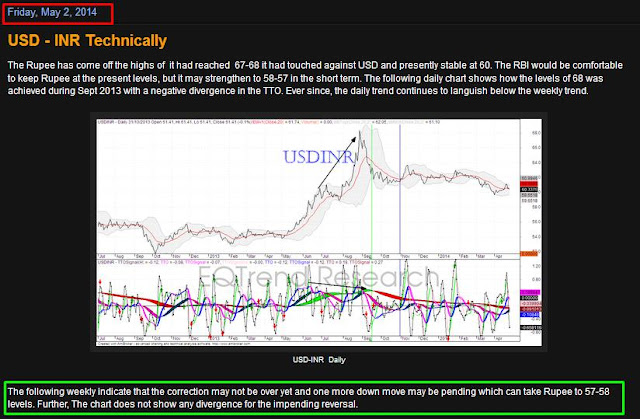

We have tracked the INR since the currency touched 67-68 levels in 2013 when in fell to the lowest level ever against the USD. In our post USD- INR Technically dated May 2, 1014, we had indicated that the INR was likely to reverse after touching 57-58 levels. It sure did reverse from those levels and started weakening during 2014. The reversal also indicated the possibility of INR retesting the 2013 lows.

Again, as early as January 5 , 2015 in our post Rupee Heading to Previous lows ? we had indicated INR to head towards 66-68 levels as the Trend Oscillator had setup a bullish pattern on TTO indicating an rapid INR move in the coming months. A close above 63.80 was the trigger, which has now intensified the weakness in the Indian currency. Further lower level to 68-69 cannot be ruled out, though the levels may be short lived.

We anticipate the INR to appreciate post this correction as the current weakness could be the last weak spot in the INR for a long time to come.

The Rupee may gradually gather strength post the present correction and move back to 62-58 levels in the long run and turn out to be one of the strongest currency.